Source:

Biotech stocks have been one of the market’s hottest spots in recent years. But when markets get a sudden chill, as they did this month, big pharmaceutical shares are a better bet.

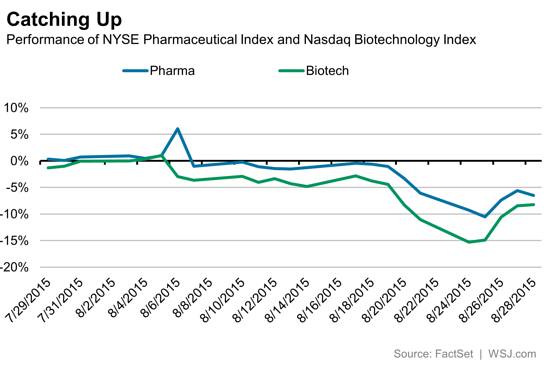

Over the past four years, a broad index of biotech stocks has outperformed a pharmaceutical index by 107 percentage points. This month, the pattern reversed; biotech has underperformed by two percentage points in August.

And, should markets remain unsettled, big pharmaceutical stocks could continue to offer a haven. That is especially the case if long-term interest rates remain subdued, given the dividend yields they offer.

Because dividend yields move inversely to share prices, the selloff has made those payouts even more attractive. Four U.S. pharmaceutical companies— AbbVie, Johnson & Johnson, Merck, and Pfizer—now offer dividend yields above 3%. That also has helped reverse a trend of falling yields for the companies, as investors had previously snapped up bond-like stocks.

These payouts are relatively attractive with the 10-year Treasury note yielding just over 2%. While pharmaceutical payouts are more meager when compared with those of, say, big oil companies, they also appear to be more sustainable. Consider that, on average, dividend payments account for just half of the free cash flow generated over the past 12 months by the four big pharmaceutical companies.

Meanwhile, the selloff has made valuations more attractive. Merck, for example, now trades at 15 times forward earnings, down from 18 times in January.

Of course, even cheap stocks can be risky. Pfizer traded at less than six times forward earnings at the nadir of the 2009 bear market. And with high prescription drug prices drawing negative attention from patients, payers and politicians alike, the sector isn’t without potential pitfalls.

In a bull market, steady stocks tend to underperform growth names. If recent market turbulence turns out to be a blip, biotech is likely to again grab the attention of growth-seeking investors.

If the market mood is shifting, though, steady cash flows on offer from big pharmaceutical firms may spare investors from unwelcome excitement.