Source: USA Today

U.S. pharmaceutical giant Pfizer(PFE) and Irish rival Allergan(AGN) Monday announced a record-breaking $160-billion merger, the largest in health-care industry history and the biggest yet using a controversial tax-saving strategy.

In a transaction expected to create the world’s largest drugmaker, the companies said Allergan shareholders would receive 11.3 shares of the newly combined company for each of their existing shares, while Pfizer investors will get one share of the new company for each of their shares.

The stock transaction is currently valued at $363.63 per Allergan share, for a total enterprise value of roughly $160 billion based on the $32.18 per share closing price of Pfizer stock on Nov. 20, the companies said.

Pfizer, the maker of erectile dysfunction medication Viagra and cholesterol-lowering drug Lipitor, and Allergan, whose brands include cosmetic medication Botox, predicted the combined company would have more than $25 billion in operating cash flow starting in 2018.

The deal terms call for the companies to combine under Allergan plc, which will be renamed Pfizer plc and trade on the New York Stock Exchange under the PFE ticker. The new combination would retain Allergan’s legal and tax domicile in Ireland. Pfizer would have its global operational headquarters in New York and its principal executive offices in Ireland.

The agreement is expected to face substantial regulatory scrutiny before its expected closing in the second half of 2016.

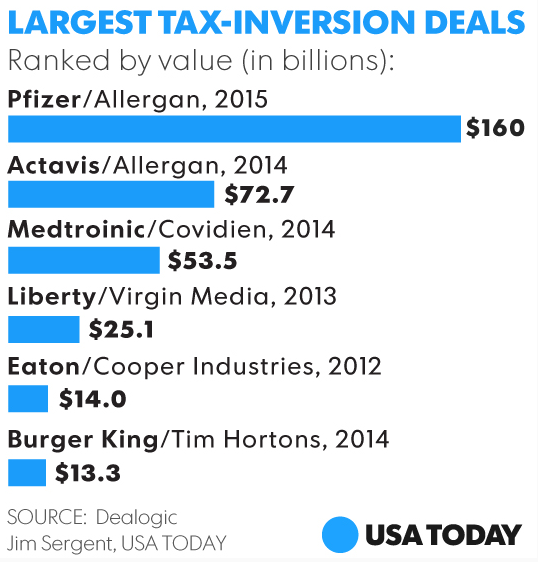

The deal comes four days after the Obama administration stepped up its attack on corporate tax inversions; transactions in which a U.S. company reincorporates in a lower tax jurisdiction overseas in a bid to cut future tax bills. Treasury Secretary Jacob Lew said the restrictions, the second aimed at inversions in two years, were aimed at shoring up the nation’s tax base.

However, the new rules are not expected to have any immediate impact on the deal because the transaction is technically structured to have Dublin-based Allergan, with a market cap of roughly $122 billion, acquire New York-headquartered Pfizer, which has a market cap of approximately $200 billion.

Despite the transaction structure, Ian Read, Pfizer’s CEO and chairman, will hold both those roles in the newly combined company. Allergan CEO Brent Saunders will serve as president and chief operating officer of the new company.

Additionally, Pfizer plc’s board is expected to have 15 directors, including all of Pfizer’s 11 current directors and four current directors from Allergan.

As a result of the transaction, Pfizer said it now expects to make a decision about a possible separation of the combined company’s innovative and established operations into separate firms by the end of 2018.

“Allergan’s businesses align with and enhance Pfizer’s businesses, creating best-in-class, sustainable, innovative and established businesses that are poised for growth,” Read said in a statement issued with the deal announcement. “Through this combination, Pfizer will have greater financial flexibility that will facilitate our continued discovery and development of new innovative medicines for patients, direct return of capital to shareholders, and continued investment in the United States, while also enabling our pursuit of business development opportunities on a more competitive footing within our industry.”

Saunders characterized the deal as a “highly strategic, value-enhancing transaction” and said it represents “the next chapter in the successful transformation of Allergan allowing us to operate with greater resources at a much bigger scale.”

Pfizer shares were down 7.74% at $31.62 before U.S. financial markets opened. Allergan shares were up fractionally at $312.72.